Calculate tax basis rental property

The most desirable locations receive a score of 100. The tax rate can vary from 0 to 396 depending on.

Rental Property Depreciation Rules Schedule Recapture

We found 22 addresses and 23 properties on Dallas Pike in Dallas WV.

. It reports the Net Cost of Owning the expected. We Can Calculate Rent Prices Based On Location and Apartment Size. Rental income tax breakdown.

For example take a house that has a basis of 99000 and that was put into service on July 15. Ad Our free guide may help you get the facts before taking the dive. For the first year youll depreciate 1667 or 165033 99000 x.

There are two rankings. Select an address below to search who owns that property on Dallas Pike and uncover many additional details. As a result your taxable rental income will be.

The APV United States Property Location Ranking shows scores for property locations on a scale of 1 to 100. Calculate state and local sales and lodging taxes even for out of state properties. This can be used to quickly estimate the cash flow and profit of an investment.

All real estate not exempted is taxed evenly and consistently on one current market. Ad We Use Proprietary Technology Data To Provide a Rent Comparison Analysis. Original cost basis for a rental property.

How is tax basis calculated on rental property. The cost basis for rental real estate is your acquisition cost including any mortgage debt you obtained minus the value of. The states statutory rules and regulations must be followed in the citys administration of taxation.

The tax rate can vary from 0 to 396 depending on two. Calculate gain on sale of rental property. If after the obligatory holding period the converted property is sold at a gain the basis in the converted property is the original cost plus amounts paid for capital improvements less any.

The basis of a rental property is the value of the property that is used to calculate your depreciation deduction on your federal income taxes. The original cost basis of a rental property is the purchase price plus certain closing costs that must be capitalized instead of expensed. The Housing Cost Calculator updated in June 2007 compares the cost of owning a home relative to renting for a potential new homeowner.

If you sold the property for 600000 your gain will be 163000 600000 amount realized minus 437000 adjusted basis. You can claim 1000 as a tax-free property allowance. Ad Avalara makes it easier to apply the right property rental tax on your customer bookings.

Your rental earnings are 18000. 1 Rule The gross monthly rental income should be 1 or more of the property purchase price after. Selling Price of Rental Property Adjusted Cost Basis Capital Gains x Tax Rate Depreciation x 25 Tax Rate.

Selling Price of Rental Property - Adjusted Cost Basis Capital Gains x Tax Rate Depreciation x 25 Tax Rate. The Internal Revenue Service IRS. Cost basis of rental property is based on the numbers you personally entered when you first entered the property into the program the first year you started using the.

This Flowchart Could Help You Decide Whether To Buy Or Rent A Home Renting Vs Buying Home Renting A House Buying Your First Home

Rental Property Depreciation Rules Schedule Recapture

Depreciation For Rental Property How To Calculate

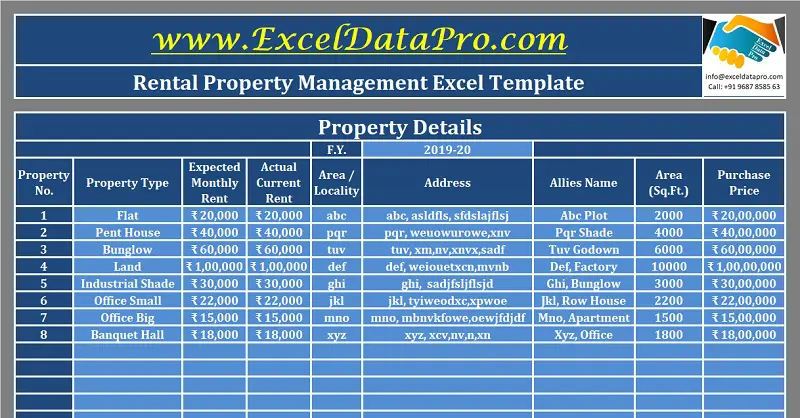

Download Rental Property Management Excel Template Exceldatapro

Depreciation For Rental Property How To Calculate

How To Create A Rental Property Management Application From Scratch Part 1 Free Download Youtube

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Rental Property Accounting 101 What Landlords Should Know

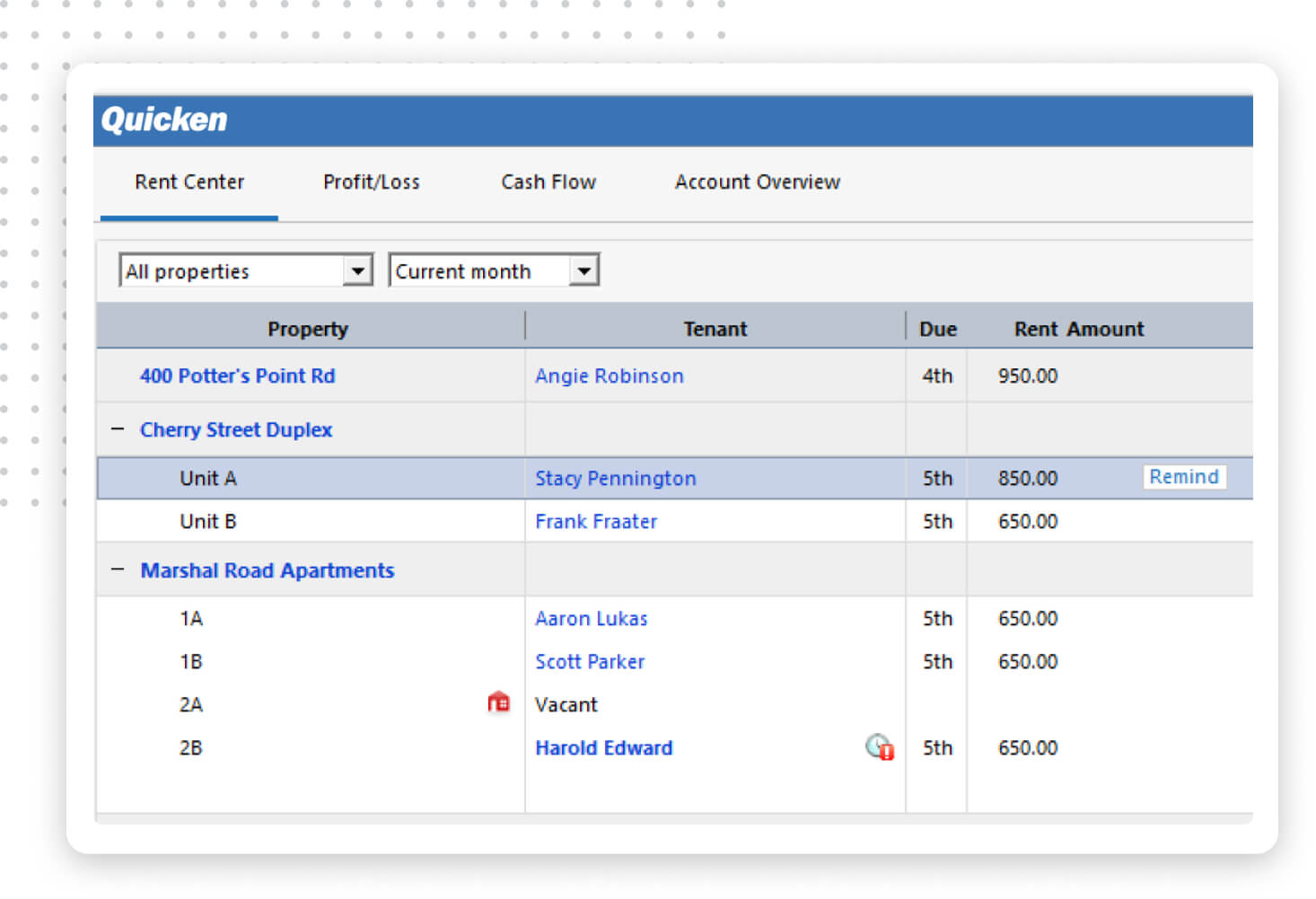

Quicken Rental Property Manager The Easy Way To Manage Your Real Estate

How To Calculate Rental Income The Right Way Smartmove

Converting A Residence To Rental Property

Pin On Rental Property Investment

Investment Property Excel Spreadsheet Rental Property Rental Property Investment Investment Property

How To Calculate Roi On Residential Rental Property

How Rental Income Is Taxed Property Owner S Guide For 2022

How To Calculate Cost Basis For Rental Property

Renting Vs Owning Home Rent Vs Buy Being A Landlord Mortgage